We understand Trust accounts.

Savings solutions for trustees, who have control over assets or money that belong to a Trust.

Why bank with us?

At United Trust Bank, we make trust banking simple and flexible, and our trust accounts are available to a variety of types of trusts, with no fees or charges. Enjoy same-day access to your account balance and manage your Trust finances effortlessly utilising our range of solutions.

Hold a trust account with us already? Click here if you wish to open another.

Trustee Reserve Deposit Account

Our Trustee Reserve Deposit Account provides you with flexibility and access to your funds for the day to day running of the trust.

Each trustee and beneficiary named on the account can withdraw funds up to twice a month, with funds sent directly to the nominated bank account.

A variable rate* of 0.50% Gross/AER** is paid on balances of £15,000 and over.

The Trustee Reserve Deposit Account has a minimum balance requirement of £15,000 and a maximum balance of £2m, on top of this we also offer a range of Trust Savings Accounts.

Please note, to access our range of Savings Accounts for Trusts you must open a Trustee Reserve Deposit Account and maintain a minimum balance of £15,000.

Click here to find out more.

*The interest rate is variable which means it can move up and down at the banks discretion.

** AER stands for Annual Equivalent Rate and illustrates what the interest rate would be if interest was paid and compounded once each year. Gross is the interest rate without tax deducted.

What You’ll Need to Get Started

It’s easy to open a trust account with us, but before you begin, here are a few key things to note:

– We only accept applications from Trusts that are already established, and we require a certified copy of your Trust deed

– Your trust must be registered in the UK, and we require a copy of the Trust Registration Service (TRS) proof of registration document (if applicable)

– Trustees must be over the age of 18 and reside in the UK

Further information about our accounts and criteria can be found in our terms and conditions here.

Explore Our Competitive Rates

Looking to maximise returns on your trusts cash balances? At United Trust Bank, we offer competitive rates on both our Trustee Reserve Deposit Account and our Trust Savings Accounts. As part of the application process, you can choose to open additional Savings Accounts to sit alongside your Trustee Reserve Deposit Account.

Whether you are seeking stability, growth or flexibility our Trust solutions are designed to support your goals.

To view our latest rates and discover how we can support your Trust, click the link below.

Frequently asked questions

What are trust savings accounts?

They are accounts specifically designed for trusts enabling them to earn potentially higher rates of interest on funds they don’t need for day-to-day expenses.

What types of trust can apply for a savings account?

We accept applications from bare trusts, discretionary trusts, and personal injury trusts. You will need to supply a certified copy of the trust deed as part of the application process, and we are required to identify and verify all named individuals (settlors/testators, trustees, beneficiaries and controllers and protectors). All of these checks are done electronically where possible.

What are the types of savings accounts I can open with United Trust Bank?

We offer a Trustee Reserve Deposit Account and a range of notice accounts and fixed term bonds for your Trust.

You will first need to open a Trustee Reserve Deposit Account in order to open any additional savings accounts with us.

You can find details on our Trustee Reserve Deposit Account and suite of other accounts, here.

What is the UTB Trustee Reserve Deposit Account?

The Trustee Reserve Deposit Account is an account we offer to trusts to help with the day to day running of the trust, it provides trustees with flexibility to access funds when they need to.

Each Trustee or Beneficiary can withdraw funds up to twice per month, each payment can be for a maximum value of £10,000 and will be sent directly to their nominated bank account. Please see our Terms and Conditions for further information on payments here.

To open any fixed term or notice accounts available to trusts the trust must have opened a Trustee Reserve Deposit Account and maintain a minimum balance of £15,000. Further information can be seen here in our Product Guide.

Do I have to use an intermediary to apply for a trust account with United Trust Bank?

No, you do not need to use an intermediary to apply for a trust savings account with us – you can open an account with us directly if you prefer. For more details, please see How do I apply for a trust savings account? below.

What is the minimum and maximum I can invest in a trust account?

Our Trustee Reserve Deposit Account has a minimum balance requirement of £15,000 and for Fixed Term and Notice Accounts the minimum balance requirement is £5,000.

The maximum balance for the Trustee Reserve Deposit Account is £2,000,000 and for Trust Fixed Term and Notice Accounts the maximum deposit is £5,000,000. If you have a requirement outside of these limits please contact here.

Are trust savings protected by the FSCS?

If your funds are held in a bare trust, each eligible beneficiary is protected by the Financial Services Compensation Scheme (FSCS) up to £85,000. If any beneficiary holds a separate account with us, please note this protection cover incorporates all accounts held.

For funds held in a non-bare trust, the £85,000 protection cover is applied to the trust rather than the individual trustees. Any trustees with an interest in more than one non-bare trust are protected up to £85,000 per trust.

For more information on the FSCS protection, please visit the FSCS website or click here.

How do I apply for a trust savings account?

To open our Trust Fixed Term or Notice Accounts a Trustee Reserve Deposit Account must be held first; to start the application process please register your interest here and our dedicated team will get in touch to talk through the next steps.

If you wish to apply for a Trust Savings account and already have a Trustee Reserve Deposit Account open in the name of the Trust please visit our product page to open your account.

What information will I need to provide as part of my application?

When submitting an application, you will need to provide details of the trust and any individuals you want to operate as signatories on the account. These details will be made clear in the application process. You will also need to provide a copy of the trust deed and the Trust Registration Service (TRS) document (where applicable).

We will also need to verify the identity of all named individuals (settlors/testators, controllers and protectors, trustees, and beneficiaries). Whilst we run an electronic identity check upon receipt of the application, we may on occasion require manual documents or further information to confirm an individual’s identity.

Can I still apply for an account if any of the beneficiaries are under 18?

Yes. We understand that many trusts will have beneficiaries who are ‘minors’, i.e. individuals under the age of 18. As part of our due diligence, we will need to carry out checks on any named individual in the application, including if they are mentioned explicitly by name in the trust deed.

Individuals referred to by relation only, such as ‘grandchildren of’, we will not require ID for. Any named individual under the age of 18 will otherwise need to provide certified ID as part of the trust’s application. Certification can only be completed by people in certain roles including solicitors, financial advisors, and the post office. More options are available.

We accept several forms of ID, including birth certificates, passports, National Insurance cards (if aged 16 or over), NHS medical cards, and child benefit or child tax credit documentation.

Why have I been asked to provide more information?

As part of our customer due diligence, there may be instances when we need clarification on the information you have provided. This doesn’t mean your application has not been accepted, but it may delay the account being opened. It is therefore important that any information you provide is up-to-date and accurate.

Can my trust hold multiple savings accounts?

Yes. You can choose to split your funds over multiple accounts, but please note you are only permitted to have one Trustee Reserve Deposit Account per trust.

How can I open another savings account with you as an existing customer/intermediary?

If you are an existing customer or intermediary and wish to open another trust account with us, you can do so via your online log in.

Existing customers can access their online log in here.

Existing intermediaries can access their online log in here.

When you have logged in, please send us a secure message via the Contact Centre, detailing the new account you wish to open, and we will process this for you.

Can each of the beneficiaries have a different nominated bank account for withdrawals?

If you hold a Trustee Reserve Deposit Account, each of the beneficiaries can provide their own specified nominated bank account, listed in your application, in accordance with the Trust Deed. This information is used for withdrawals, where up to two withdrawals are allowed per month. Please note, however, this is subject to a maximum of eight nominated bank accounts per trust.

The Trustee Reserve Deposit Account will act as your nominated bank for other savings products you have with us. For example, at the end of a fixed term, you can transfer some or all of the balance into your Trustee Reserve Deposit Account.

How can I withdraw funds?

You are only permitted to withdraw funds if you hold a notice account or a Trustee Reserve Deposit Account with us. Please see How do I withdraw funds from my reserve account?

Early withdrawals are not permitted on our fixed term bonds, unless under exceptional circumstances. These may include if you are in financial hardship or suffering from a long-term illness and having access to your savings would help your situation. Early withdrawals are granted entirely at United Trust Bank’s discretion, and an early withdrawal charge will be payable for breaking your bond ahead of maturity. We may also request evidence to support your request.

If you are experiencing financial hardship, please find out how we can help here.

For withdrawals from our notice accounts, simply log in to your online banking, select the relevant trust account and then choose the option ‘Make a Withdrawal’. Enter the amount you wish to withdraw and choose the date you would like the funds sent to you. If you are not yet an online banking user, you can register your details here.

Please note, to keep the account open you must have a balance of at least £15,000 left after the withdrawal. Any request will also need to be in accordance with the signing arrangements on your account, i.e. if your signing arrangements are set to ‘both’, ‘any two’ or ‘all’, the withdrawal will not be processed until we have received the appropriate approval from the other individual(s).

How do I withdraw funds from my reserve account?

Withdrawals from the Trustee Reserve Deposit Account are allowed up to twice per month per nominated account, a maximum amount of £10,000 per payment also applies. The funds will be sent directly to the Trustee/Beneficiary nominated account.

To make a withdrawal, simply log in to your online banking, select the relevant account and choose the ‘Make a Withdrawal’ option. Enter the amount you wish to withdraw and choose the date you would like the funds sent to you. Please note, to keep the account open you must have a balance of at least £15,000 left after the withdrawal.

Should you submit your withdrawal request by 5pm on a business day, the funds should reach your Nominated Bank Account on the same business day. Requests made after 5pm on a business day, or on a day that is not a business day, will be processed on the next business day.

If you make your withdrawal request in writing via post or by email and it is received by 2pm on a business day, the funds should reach your Nominated Bank Account on the same business day. Requests received after 2pm, or on a day that is not a business day, will be processed on the next business day.

The request must follow the signing rules and be received by the above respective times to be processed on the same day.

If you are not yet an online banking user, you can register your details here.

For more details, please see our Terms and Conditions.

How often are statements sent?

Statements are sent annually, either on the anniversary of the fixed term’s start date or, for our Trustee Reserve Deposit Account and notice accounts, after interest is applied on 31 October each year.

Should you prefer more frequent statements, please send us a secure message via your online banking. Alternatively, you can call us on 020 7190 5599 or freephone 0800 083 2228 between 9am and 5pm Monday to Friday, where our team will be happy to help you.

How do I update the signatories on my account?

If you want to add or remove a signatory from your account, you will need to complete a new mandate form by visiting our ‘Change of details’ page here and following the steps under the ‘Changing Mandates’ section.

You will be redirected to a page hosted by our partner DocuSign, where you will find the form itself.

Please note, you will need to supply the existing signatories’ email addresses on the form so that they can agree to any changes you make.

If we are not able to confirm a new signatory’s identity electronically, we will ask you for a copy of their ID. We will let you know when we have updated the signatories.

What happens when my account reaches maturity?

We will contact you two weeks before your bond matures to ask what you would like to do with the funds.

For online banking customers, we will also send you a text message to confirm your account is approaching maturity, and you can log in to provide your instructions from that day onwards. Please note, all signatories must have signed up or online instructions will not go through fully.

If you are not registered with us online, you can sign up here. We will send you your username and password by email. This will arrive in the form of a secure link. You will need to provide a few characters of your National Insurance number for security before being able to view the document. Please ensure you check your junk or spam folder in case our email should be diverted there.

If you don’t provide instructions before your maturity date, we will automatically transfer the full balance (including any interest earned) into your UTB Trustee Reserve Deposit Account.

How do I manage my account?

The easiest way to manage your account is via online banking. Register your details here to get started, and then you can log in here. You will then be able to send us secure messages, arrange withdrawals, provide maturity instructions, serve notice, and more.

The UTB Trustee Reserve Deposit Account can only be managed online, so please ensure if you have opened one of those accounts that you also register for online banking.

For our other trust accounts, these can also be serviced by calling us on 020 7190 5599 or freephone 0800 083 2228, or you can reach out to us via our contact form.

Is my trust eligible for online banking?

All trust types are eligible for online banking, though only your trust’s signatories will be able to sign up. To register your details, please click here.

After you have successfully registered your details, we will email you your username and a temporary password. This email should arrive within a few minutes. If it doesn’t, please check your junk or spam folders. You can then log in to online banking here. Please note, if you have not consented to email communications, your details will be sent by post.

To find out more about the access level you will have, please see Who can access online banking?

Who can access online banking?

Only signatories for your trust will have access to online banking, which includes the ability to provide maturity instructions, change their personal details, and send secure messages.

There is no limit on how many signatories you can add to your account. If you would like to add more, please complete a mandate by heading to our ‘Change of details’ page here.

You will be redirected to a page hosted by our partner DocuSign, where you will find the form itself.

Please note, you will need to supply the existing signatories’ email addresses on the form so that they can agree to any changes you make.

If we are not able to confirm a new signatory’s identity electronically, we will ask you for a copy of their ID. We will let you know when we have updated the signatories.

How do I register for online banking?

To register your details, please click here. You will need your United Trust Bank account number, National Insurance number, email address and mobile phone to hand.

You will also need to ensure you have an email address and a mobile number registered with us. Please contact us on 020 7190 5599 or freephone 0800 083 2228 between 9am and 5pm Monday to Friday if you need to update your contact details.

After you have registered your details, we will email you your username and a temporary password. This email should arrive within a few minutes. If it doesn’t, please check your junk or spam folders. You can then log in to online banking here to complete your registration

Push Notification

Below is a short video guide on how to register for online banking using push notifications:

SMS Notification

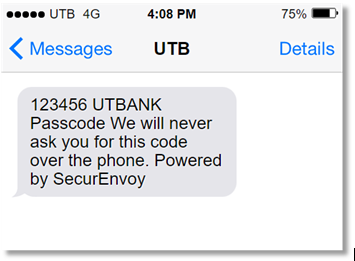

Choosing SMS means we will use a text message to complete authentication using a one-time passcode sent to your registered mobile number.

An example of the message we send for Two Factor Authentication is displayed below. You only need to enter the numbers displayed in the SMS:

What is dual authorisation and when does it apply?

Dual authorisation is required when your signing arrangements are set to ‘both’, ‘any two’ or ‘all’ to sign, i.e. you have stated that in order to make any changes or provide maturity instructions on your account, two signatories must consent separately to the request.

For online banking, this applies when you wish to provide us with maturity instructions or give notice on any account held with United Trust Bank.

How does dual authorisation work?

Dual authorisation is required when your signing arrangements are set to ‘both’, ‘any two’ or ‘all’ to sign, i.e. you have stated that in order to make any changes or provide maturity instructions on your account, two signatories must consent separately to the request. For online banking, this applies when you wish to provide us with maturity instructions or give notice on any account held with United Trust Bank

What if I hold both a personal account and a trust account?

In the event that you hold a personal account and also act as a signatory for a trust, and you want to register both for online banking, you will need to complete the registration form separately for your personal online banking and your trust online banking.

This is because account numbers are directly linked to the customer type and profile, i.e. a personal customer can only see their personal accounts on online banking and a trust customer can only see their trust accounts.

If you act as a signatory for more than one trust, you will need to sign these up separately as well since only the relevant accounts for that trust will show online.

Ways to contact us

-

Login and send us a message via online banking

-

020 7190 5599

Monday – Friday 9am – 5pm

-

Freephone – 0800 083 2228

Monday – Friday 9am – 5pm

-

United Trust Bank, One Ropemaker Street, London, EC2Y 9AW

-

Submit via our online contact form

-

Use our Help Centre to see if we can answer any of your queries online